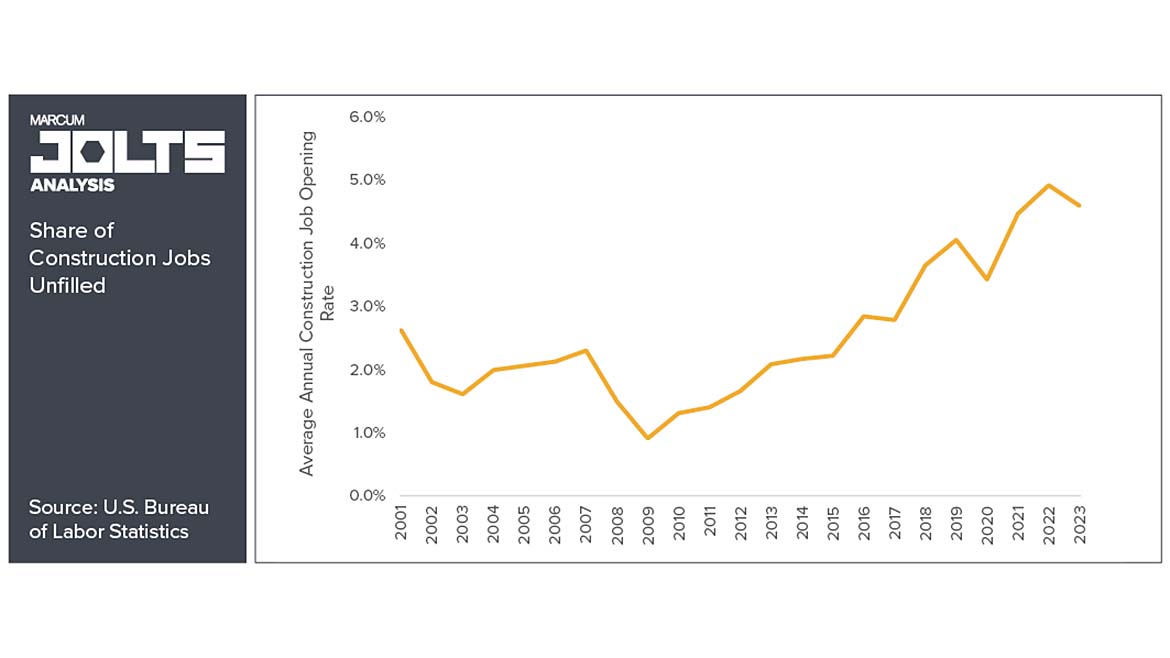

According to the JOLTS data, 4.6 percent of construction jobs remain unfilled, the second-highest level recorded. Overall, employment for drywall and insulation contractors over the past year is down by 0.1 percent from January 2023 to January 2024. The labor shortfall stands to get worse in the near future. Baby Boomers continue to enter retirement and immigration remains a contentious issue. Additionally, competition from other sectors threatens to pull workers away from construction.

What the Index Shows

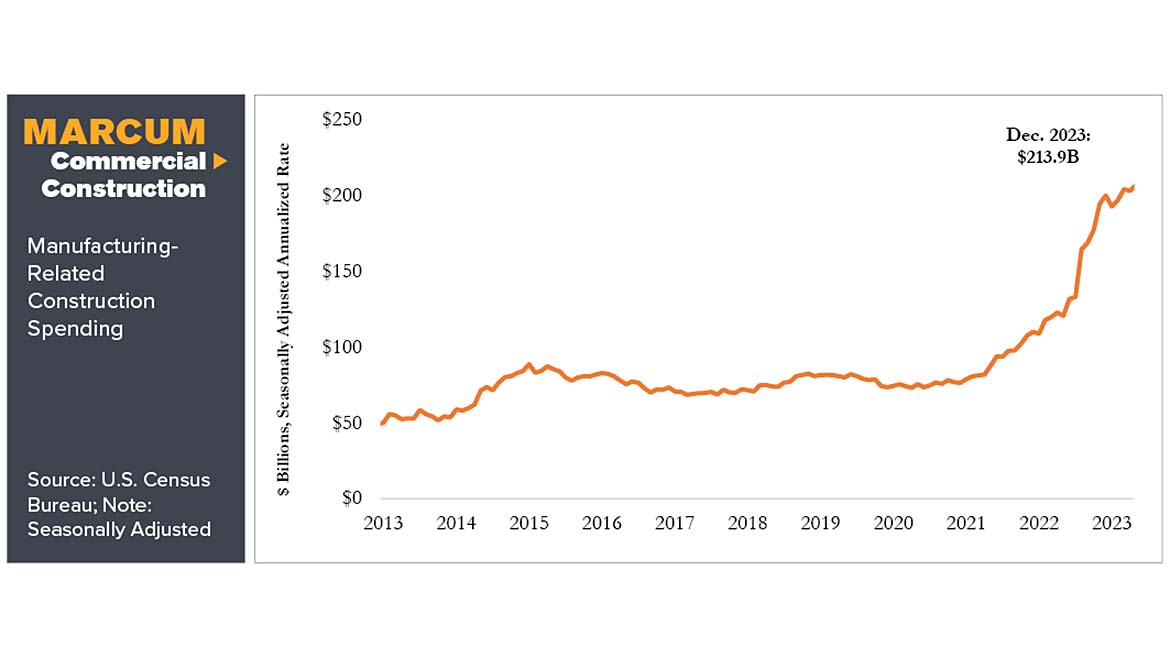

Marcum’s Commercial Construction Index from the final quarter of 2023 indicated a surge in manufacturing-related investments, with a 5.2 percent increase in spending. Over the last three years, spending in that category has increased by 186 percent. Iron and steel prices rose 1.3 percent in February but are only up 2.7 percent compared to the same time last year. This is relatively low compared to pre-pandemic years. Additionally, gypsum products are down 0.2 percent, according to the U.S. Bureau of Labor Statistics’ Producer Price Index. With demand high and material prices leveling off, the ongoing labor shortage remains the most pressing issue.

Contractors and owners, particularly those responsible for highly specialized trades, including framing, drywall, and ceiling installation, are dealing with a number of issues. The pool of labor of potential workers is shrinking, with retirements outpacing the rate at which new workers enter the industry.

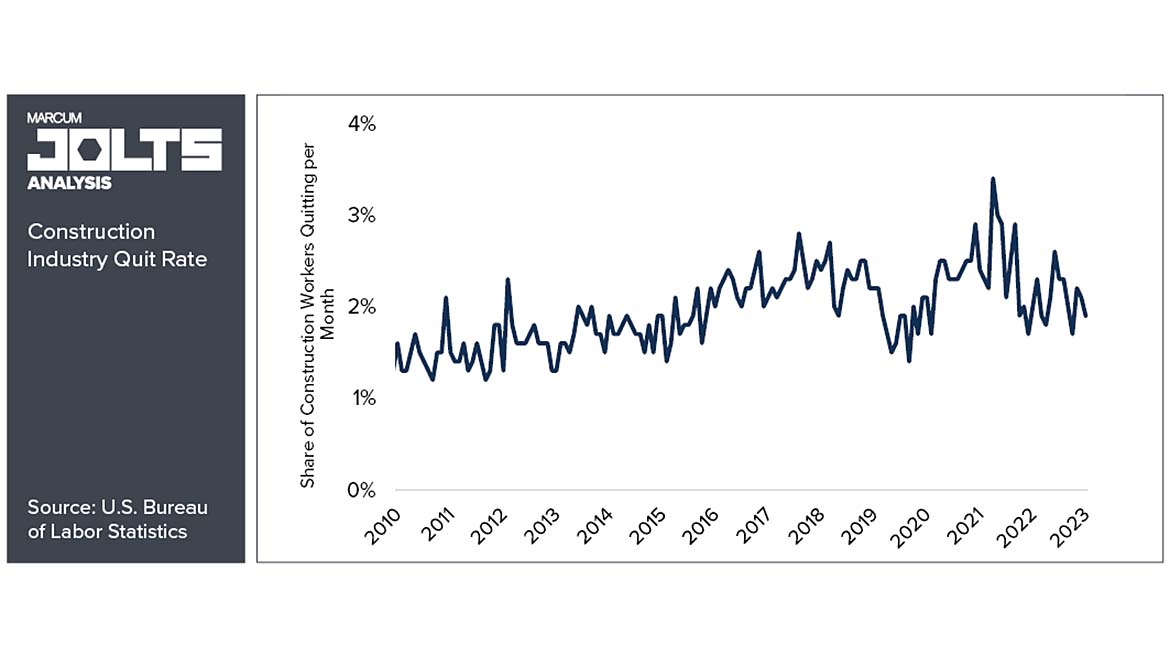

Moreover, the ramifications of construction’s current situation require additional attention. Staffing is not the only pressing matter. On the one hand, high demand is a positive sign of strong prospects in the future. At the same time, however, it is causing wages to rise and making it harder to find qualified workers. This drives project costs and puts pressure on budgets, timelines, and profit margins. Data show that the cost of labor in construction has been rising faster than in other industries since 2022.

There’s more. Even the strong quarter for the industry has not proven to be the "rising tide that lifts all boats." The commercial construction sector, a huge market for contractors specializing in interior trades, saw spending drop more than 2 percent in the fourth quarter of 2023, with an overall increase of only 1 percent over the course of the year. Enough has been said about high inflation to show that this sector is not yet treading water, much less experiencing real growth. The commercial sector may be the most obvious example of selective pressure within the construction industry but it’s not alone in feeling the pain.

Surveys Say

Marcum’s construction surveys feature the perspective of chief economist Anirban Basu. In this edition, he noted that moderating input price escalation has served as a boon for the industry, particularly in the latter half of the year. He added that global supply chain improvements and a dip in global demand helped to regulate commodity prices but added that they still were 38 percent higher than they were at the start of the pandemic.

An innovative hiring strategy remains paramount. In the short term, there is little chance of an influx of workers. For contractors, this means being competitive in recruiting workers while tempering hiring efforts by forecasting ahead of time, which will be necessary to balance labor needs and financial demands. The long-term prospects for improving the rate of workers entering the field are more open-ended. Workforce development, apprenticeship programs, and community and school-based initiatives remain essential options for firms to explore, individually and collectively, as members of industry associations and trade partnerships.

Looking ahead, it’s also important to pay close attention to actions by the Federal Reserve. Interest rates are due for a decline but inflation is still rising, and employment is strong. When and by how much rates will fall is anyone’s guess. For owners, keeping an eye on these metrics can help maintain momentum and steer through periods of volatility.

The construction industry is resilient but continues to face a stern headwind in the form of a labor shortage. By coming together to address this industry-wide issue, construction firms can help secure a stronger talent base, introduce innovative hiring measures, and better adapt to shifting economic trends. Doing so is essential if the industry is to overcome this long-standing shortage and thrive in a dynamic economic future.