Meeting IECC Thermal Requirements

Continuous insulation can meet the standards and help you reach tax incentives

As the industry evolves, staying ahead of energy standards presents challenges for builders, but it can also be a benchmark for quality and innovation. The introduction of the 2021 International Energy Conservation Code underscores the key role continuous insulation can play in new homebuilding projects.

What are the 2021 IECC Thermal Requirements?

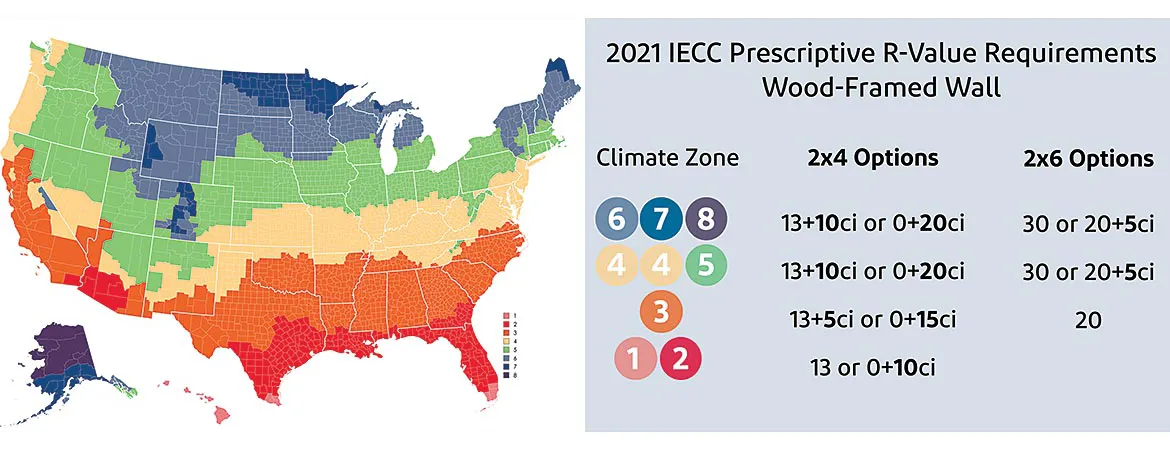

Newer energy codes encourage the use of CI as an option to meet prescriptive (wall) thermal requirements, as well as options for building thicker walls with greater cavity insulation levels. An advantage of exterior CI is that it can allow builders to continue using 2x4 construction instead of moving to 2x6 construction and the various design changes, costs and potential loss of square footage associated with that change. Whether building with 2x4 or 2x6 wall construction, exterior CI can also allow builders to use standard batt insulation and avoid using more expensive insulation types in the wall cavity.

It is estimated that adopting the 2021 IECC will deliver energy savings of at least 10 percent, or 20 percent or more in states where older codes are in place.

Here are four benefits to using CI to meet the new IECC thermal standards, taking advantage of available tax incentives.

1. ENERGY STAR and Eligibility for 45L Tax Credits

All new dwellings acquired on or after Jan. 1, 2025, seeking ENERGY STAR certification and the 45L tax credit eligibility will need to adhere to ENERGY STAR v3.2, which calls for 2021 IECC thermal requirements. These include heightened insulation requirements that are more difficult to meet without using continuous insulation in most climate zones.

2. Continuous Insulation Provides a Simple and Effective Path for Thermal Compliance

Using exterior CI in any of the climate zones can help simplify the thermal compliance process for many, providing a compliance path while optimizing performance. As a material that is continuous across all structural members and installed over framing, CI can boost the thermal performance of the building envelope and potentially reduce homeowner costs associated with heating and cooling.

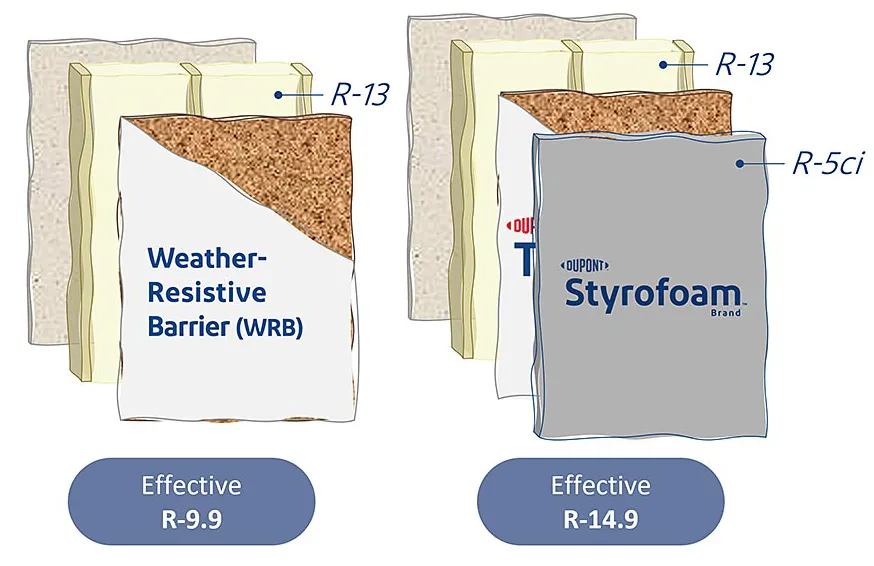

For example, adding one inch of product, like DuPont Styrofoam Brand XPS Insulation, to a 2x4 wall with R-13 batt gives you a 50 percent higher effective R-value when compared to a 2x4 with only batt.1

The U-Factor Area alternative method can also allow builders to meet code compliance through trade-offs between R-values in the roof, wall, window and foundation, rather than the prescriptive method. Using exterior CI can help achieve high UA values when compared to adding more insulation since the effective R-value of the high surface area directly affects UA.

3. Leverage Tax Incentives to Help Offset Costs

Financial incentives available through the Inflation Reduction Act of 2022 can help offset the costs of implementing CI. Builders can take advantage of these benefits through Dec. 31, 2032, when choosing to implement upgrades in energy efficiency.

The most significant incentive is the Energy-Efficient Home Credit (Section 45L), which allows builders to claim a federal tax credit of up to $5,000 per home. It’s available for homes that are certified to meet ENERGY STAR or Zero-Energy-Ready Home standards.

Here are some specific things that homebuilders can do to make their homes more energy-efficient and qualify for the 45L credit:

- Insulate the home properly;

- Install energy-efficient windows and doors;

- Seal air leaks around the home;

- Install energy-efficient appliances and HVAC systems, and;

- Use renewable energy sources, such as solar panels or geothermal heating and cooling.

If you’re not sure whether your homes meet the requirements, you can contact a certified energy rater for help. Also, talk to a manufacturer’s rep to learn if their company has a certificate that the builder can use to provide to the IRS for the tax credit. In addition, energy raters can inspect your homes and provide you with a certificate of compliance if they meet the standards.

Once your homes are certified, you can file for the tax credit using IRS Form 8908.

4. Continuous Insulation Enhances Building Performance and Homeowner Value

The use of CI in new homebuilding offers additional benefits beyond compliance. Its application can mitigate condensation potential, thus reducing the likelihood of callbacks related to moisture management. The optimized thermal envelope and higher effective R-value can also mean reduced HVAC equipment, less energy usage and, thus, lower energy bills for the homeowner, leading to significant long-term savings.

Regardless of how you reach the new building codes, it’s best to work with manufacturers that provide in-field support for their products; someone a builder can talk to and discuss installation training and any design-related challenges.

Calculations assume 16-inch o.c. framing and the following material R-values:

• Interior air film – an R-value of 0.68

• Half-inch gypsum – an R-value of 0.45• Two-by-four – an R-value of 3.71

• Two-by-six – an R-value of 5.83

• Half-inch OSB – an R-value of 0.62

• One-inch Styrofoam XPS – an R-value of 5

• Exterior air film – an R-value of 0.17

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!